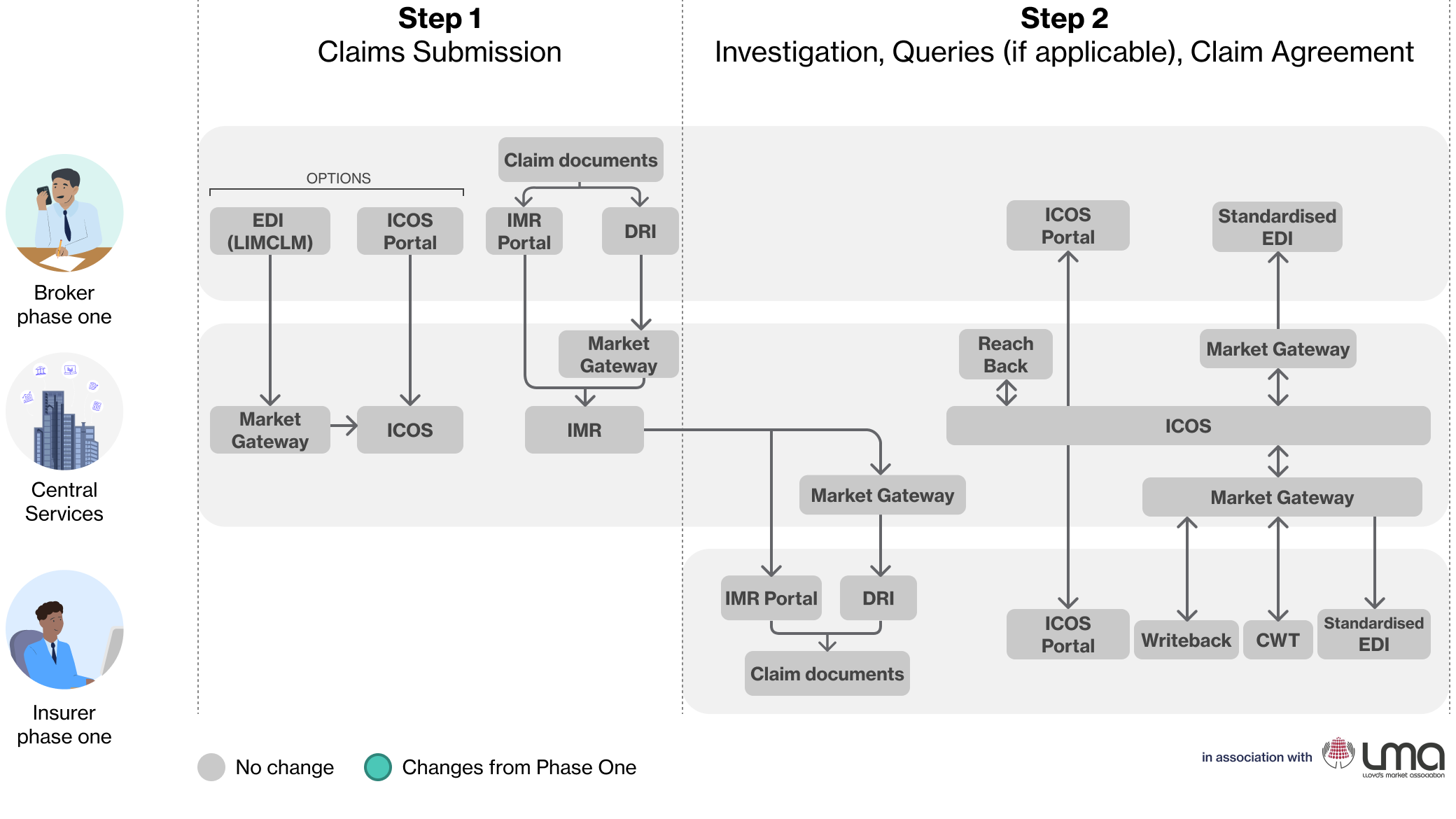

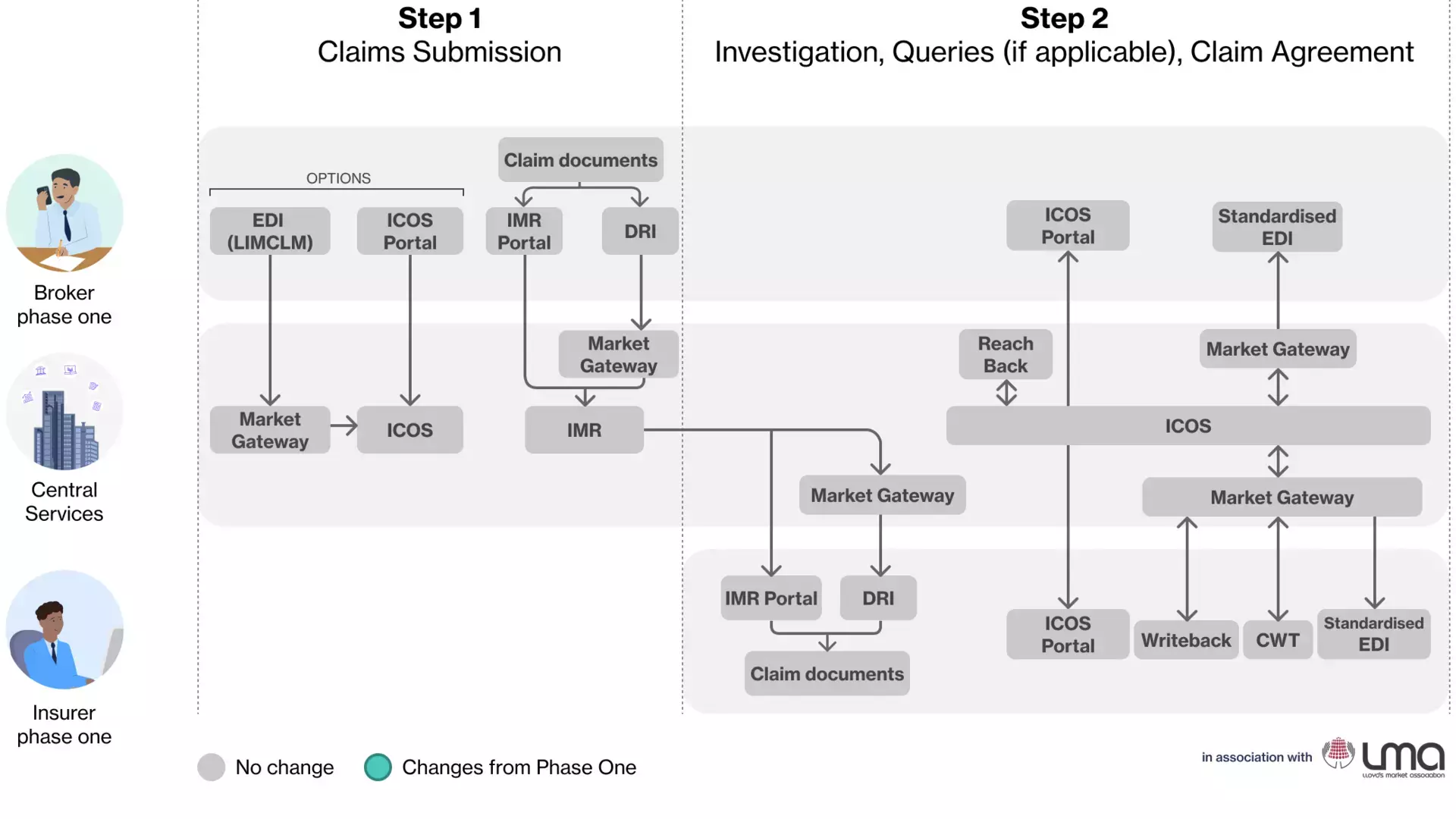

In this scenario, both the Broker and the Insurer have only adopted phase one solutions.

Step 1: Claims Submission

EDI (LIMCLM)

Brokers will be able to submit LIMCLM via the Market Gateway (ASG Adept) to ICOS for claim submission (either for FNOL or for a new movement on an existing claim). This will remain unchanged from phase one.

Market Gateway

EDI messages, such as LIMCLM, must go through the Market Gateway (ASG Adept), this is unchanged from phase one.

ICOS Portal

As an alternative to LIMCLM, brokers also have the option to submit claims through the ICOS portal, this remains unchanged from phase one.

ICOS

ICOS is the new claims processing platform replacing ECF and CLASS. It will remain unchanged from phase one, although there will now be the option to interact with it via ECOT, EBOT and API.

Claim documents

Claim documents will continue to be submitted to the IMR as part of the claim process via the IMR portal or DRI.

IMR / IMR Portal

The IMR will continue to be the platform that will store claim documents. The IMR portal will remain unchanged from phase one.

Step 2: Investigation, Queries (if applicable), Claim Agreement

ICOS Portal

Both insurers and brokers (regardless of what phase they are in) are able to submit, view and respond to queries via the ICOS portal.

The ICOS Portal can also be used in the investigation process in claims, where insurers and brokers can upload and download supporting evidence to a claim. The ICOS portal will orchestrate the process of the agreement parties agreeing the claim. The broker can view the agreement status live in the portal.

There are currently no dedicated roles in ICOS for third parties. Therefore, insurers and brokers will be responsible for managing queries and investigation with third parties out of ICOS.

Reach Back

The Reach Back service will remain unchanged from phase one. It will enable legacy cases to be handled where claim data cannot be found in ICOS. In such situations, Reach Back will pull data from the old systems (e.g. CLASS, ECF, LIDS) into the new systems, IPOS and ICOS.

If Reach Back is required for a claim, it will be used once only:

-

At FNOL, ICOS will look for premium information in IPOS. If it is not found, Reach Back will pull historical data from LIDS.

-

If a claim originated in CLASS and a subsequent submission happens in ICOS, then the Reach Back service will get the previous claim history from CLASS.

-

Raw historical LIDS and CLASS data will not be directly accessible by insurers and brokers, this is unchanged from phase one.

If there is a future subsequent submission in ICOS after that, there will be no more Reach Back calls because all the information will already be in IPOS and ICOS.

Market Gateway

EDI messages, Writeback and CWT will go through the Market Gateway (ASG Adept), this is unchanged from phase one.

Writeback / CWT

Both Writeback and CWT will be available during phase one and phase two, with a plan to sunset these services at some point later in phase two when the market deems them no longer necessary. Specific timelines have not been confirmed.

Writeback and CWT will be accessed via the Market Gateway (ASG Adept), this is unchanged from phase one.

Standardised EDI

Insurers who are still in phase one will receive Standardised EDI messages as they do in phase one.

Managing Agent playbook links

Phase one

Phase two

Preparation

What is changing?

What is not changing?

What to do and when?

Known unknowns

Placement

Broker & Insurer phase one

Broker & Insurer phase two

Claims

Broker & Insurer phase one

Broker Phase two, Insurer Phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two

Premium Accounting & Settlement

Broker & Insurer phase one

Broker phase two, Insurer phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two

Claim Accounting & Settlement

Broker & Insurer phase one

Broker phase two, Insurer phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two