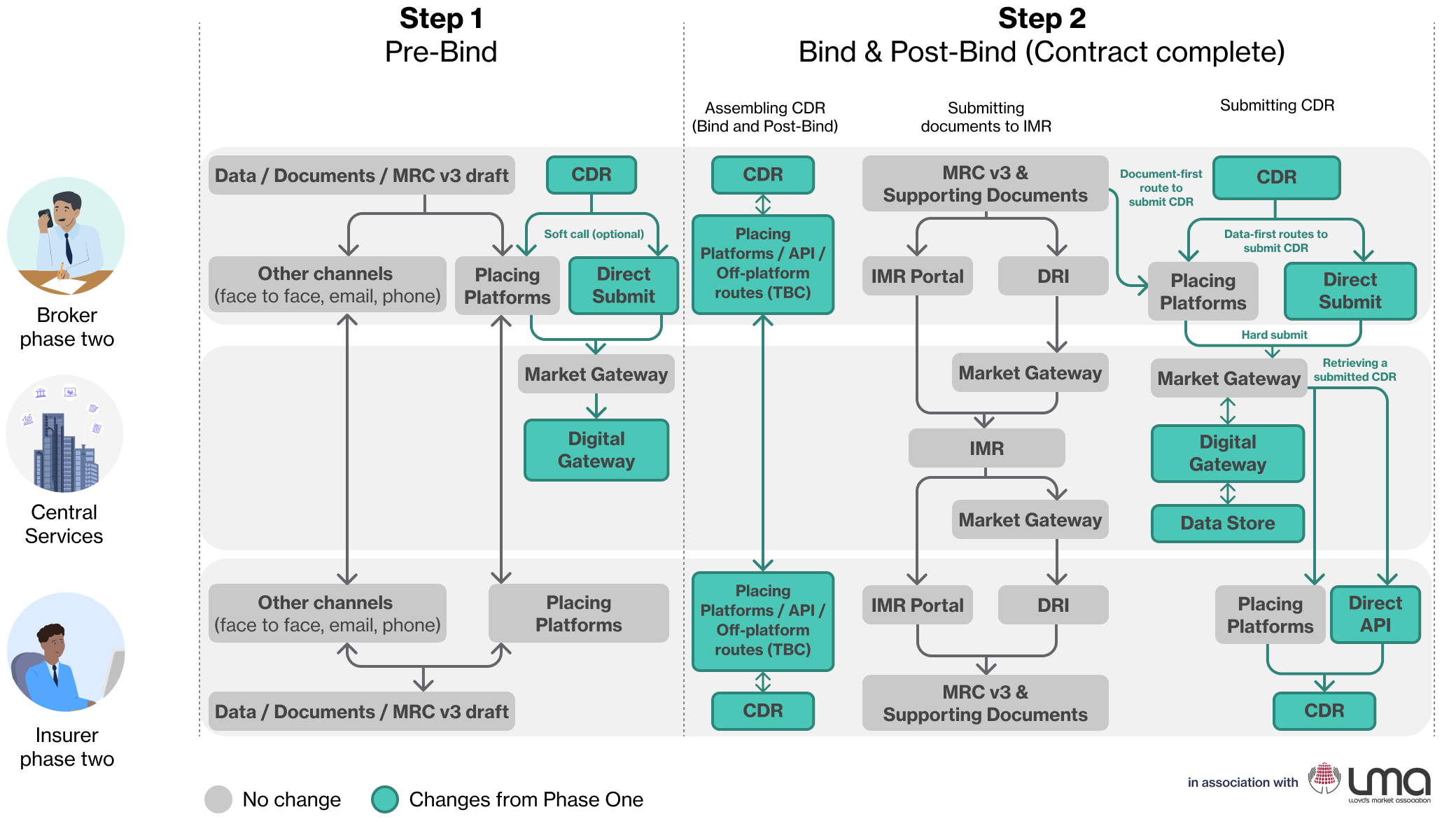

In this scenario, both the Broker and the Insurer have adopted phase two solutions for placement. Insurers start providing and approving CDR fields at Bind and Post-Bind alongside the broker. The Broker submits the CDR to the Digital Gateway (IROS), after which the Insurer can retrieve it and use it in downstream systems.

Please note, the CDR process will only work if the Broker and all Insurers on a policy have adopted the CDR and the Process, Roles and Responsibilities. If this is not the case, then the policy will have to be placed without a CDR and the premium will be processed manually.

Please note, some types of business will not be covered by the CDR and Digital Gateway, e.g. Delegated Authority, including binders, line slips and consortia, Treaty Reinsurance, Verticalised policies, policies with subjectivities, adjustable premiums, sections with certain premium splits (e.g. multiple perils, insured interests). These policies will have to be placed without a CDR and to be processed manually by the Joint Ventures

Step 1: Pre-Bind

Data / Documents / MRC v3 Draft

Brokers will continue to originate the MRC documents during phase two, and document exchanges are expected to happen as they do today, using the same placing platforms or other channels between brokers and insurers.

There are no changes to the MRC v3 related to the phase two go-live, but at this point, MRC v3 is expected to have been adopted for the majority of the contracts in the market.

CDR

Brokers who adopt phase two will start to originate the Core Data Record (CDR) along with the MRC.

The CDR will be a centralised digital risk record for open market policies that will facilitate more automated premium and claim processing in IPOS and ICOS. Use of the CDR will become available in phase two.

At pre-bind, it would only be possible to complete a partial CDR because not all data will be available at this point.

The broker can choose to make a soft call of the CDR draft to the Digital Gateway (IROS), this will return any failed validation rules and will not save a record of the CDR.

Market Gateway

The Market Gateway (ASG Adept) will remain unchanged from phase one, but it will introduce new access points for phase two interactions. It will be the physical gateway used to access the Digital Gateway (IROS), IPOS and ICOS. The Market Gateway (ASG Adept) will be a different gateway from the Digital Gateway (IROS).

Digital Gateway

The Digital Gateway (IROS) will have the gateway services that will handle the CDR, which will go live in phase two. This will be distinct from the Market Gateway (ASG Adept) that goes live in phase one. The Digital Gateway (IROS) will be accessed through the Market Gateway (ASG Adept).

At pre-bind, brokers have the option to perform a soft call of their CDR draft to the Digital Gateway (IROS), which will return any failed validation rules and will not store a record of the CDR. The broker can do that either via a placing platform or via direct submit.

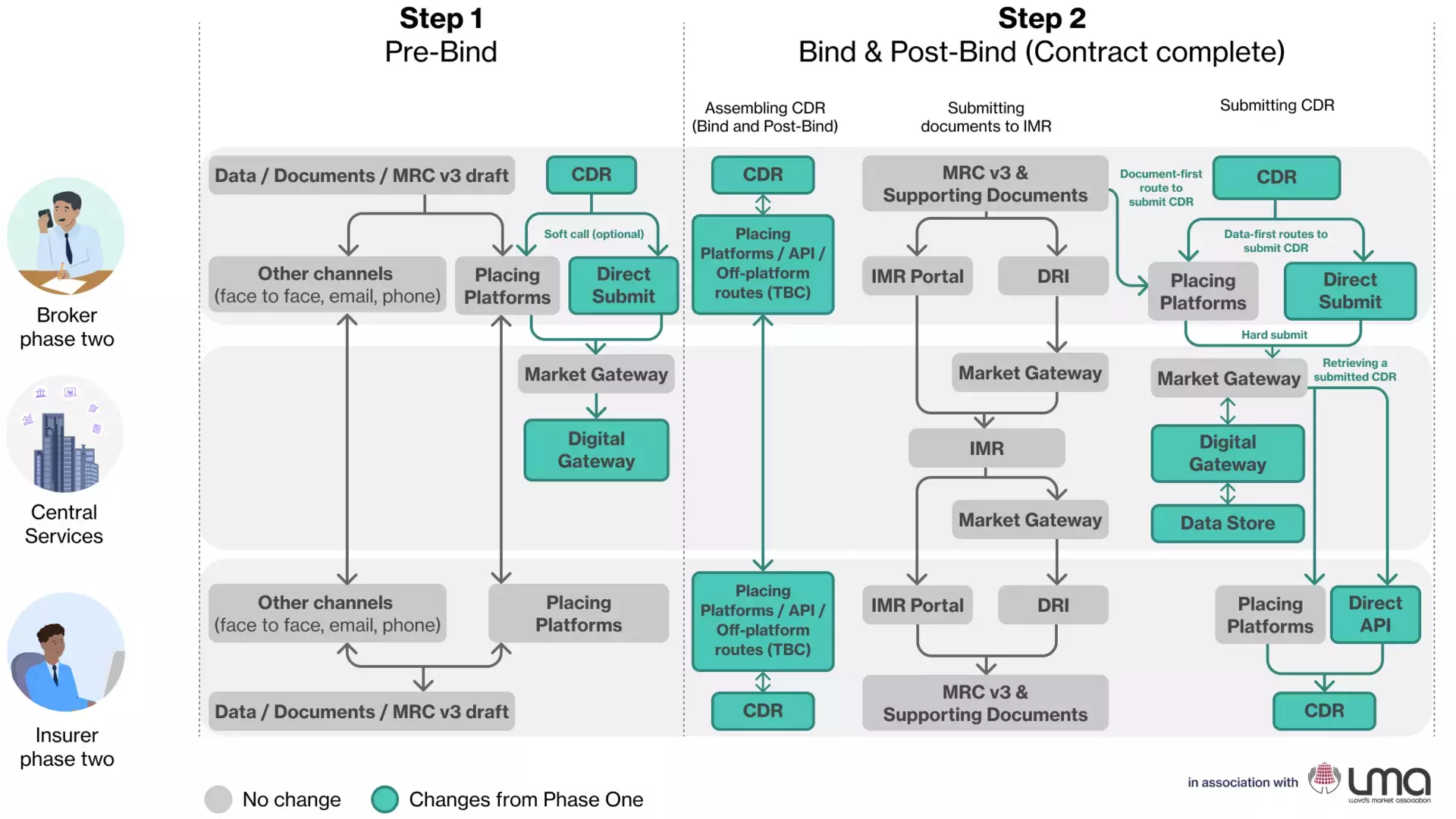

Step 2: Bind and Post-Bind (Contract Complete)

MRC v3 and supporting documents

Once the contract is complete and the MRC v3 has been finalised, the broker will upload it to the IMR as they do today.

CDR

Brokers who adopt phase two will also originate the CDR along with the MRC.

At the points of bind (written line) and post-bind (contract complete), insurers will have responsibilities to create and review certain CDR fields. They can do that either via a Placing Platform, API, or off-platform routes (TBC). Please check with your placing platform vendors to ensure that they plan to have this functionality.

Off-platform routes are currently to be defined. There is going to be an accredited process for insurers and brokers to create and approve CDR fields, but this process is currently to be confirmed. It is currently not known whether the process will require the use of placement platforms or APIs, or whether traditional methods like email will suffice.

Full process, roles and responsibilities can be found here and full details on CDR fields can be found here.

Once a CDR is assembled, the broker can submit it to the Digital Gateway (IROS) in three ways:

-

Data-first via a placing platform (which will use an API behind the scenes)

-

Data-first via API

-

Document-first via a placing platform (which will convert it to data and use an API behind the scenes)

If a CDR is missing, this means that validation and technical processing (adding tax and regulatory information) cannot happen automatically. Velonetic will still have a manual process in place to handle this, the manual process will require an MRC.

Once a CDR is submitted to the Digital Gateway, insurers can retrieve it, either via a Placing Platform or via Direct API. The CDR can be used in the insurer’s downstream processes.

Placing Platforms / API / Off-platform routes (TBC)

Placing platforms are one of the routes for assembling and submitting the CDR. The expectation is that the process of assembling and submitting a CDR would be triggered by the broker, while the insurer will have responsibilities to approve or create CDR fields. Full process, roles and responsibilities can be found here and full details on CDR fields can be found here.

Placing platforms can submit the CDR either via a Document-first or a Data-first route. Please check with your placing platform vendors which routes they will be supporting.

PPL have announced their plans for phase two readiness, please see the What is changing section for more detail.

Alternatively, insurers can choose to assemble the CDR with the broker via a direct API, or via off-platform routes (TBC). There is going to be an accredited process for insurers and brokers to create and approve CDR fields, but this process is currently to be confirmed. It is currently not known whether the process will require the use of placement platforms or APIs, or whether traditional methods like email will suffice.

Direct Submit

For brokers, this is an alternative data-first method of submitting the approved CDR to the Digital Gateway (IROS).

Digital Gateway

The Digital Gateway (IROS) will perform validation rules to ensure that the submitter has provided all necessary information to meet the market agreed data standard and to comply with further risk validation rules to support downstream processing. In addition to that, the Digital Gateway (IROS) will calculate derived fields, e.g. FIL codes.

The Digital Gateway (IROS) will have no query process because it will be fully automated. If a submission passes the validation rules, the data will be stored into the Data Store. If validation fails, the failing validation rules will be returned to the submitter.

Once a completed CDR has been submitted to the Digital Gateway (IROS), it can be retrieved by insurers participating on the risk. This can happen either via a placement platform or via direct API. Please check with your placement platform vendors if they will have this capability.

The Digital Gateway (IROS) will be accessible via the Market Gateway (ASG Adept).

Direct API

An alternative route for insurers to retrieve the completed CDR from the Digital Gateway (IROS) and the Data Store, in case their placement platform vendors are unable to provide this functionality. Please note, the Digital Gateway (IROS) will be accessible via the Market Gateway (ASG Adept).

Managing Agent playbook links

Phase one

Phase two

Preparation

What is changing?

What is not changing?

What to do and when?

Known unknowns

Placement

Broker & Insurer phase one

Broker & Insurer phase two

Claims

Broker & Insurer phase one

Broker Phase two, Insurer Phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two

Premium Accounting & Settlement

Broker & Insurer phase one

Broker phase two, Insurer phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two

Claim Accounting & Settlement

Broker & Insurer phase one

Broker phase two, Insurer phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two