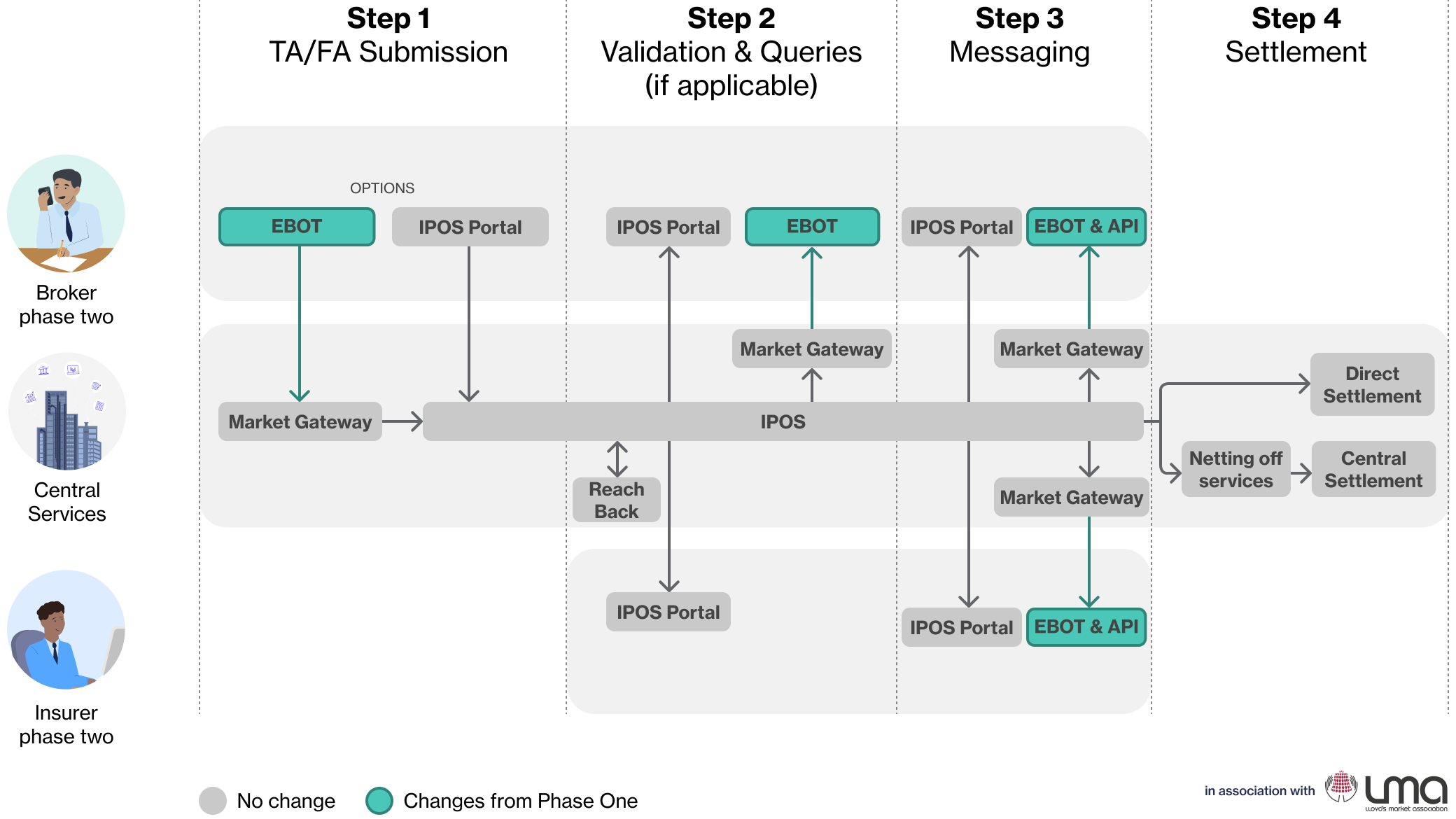

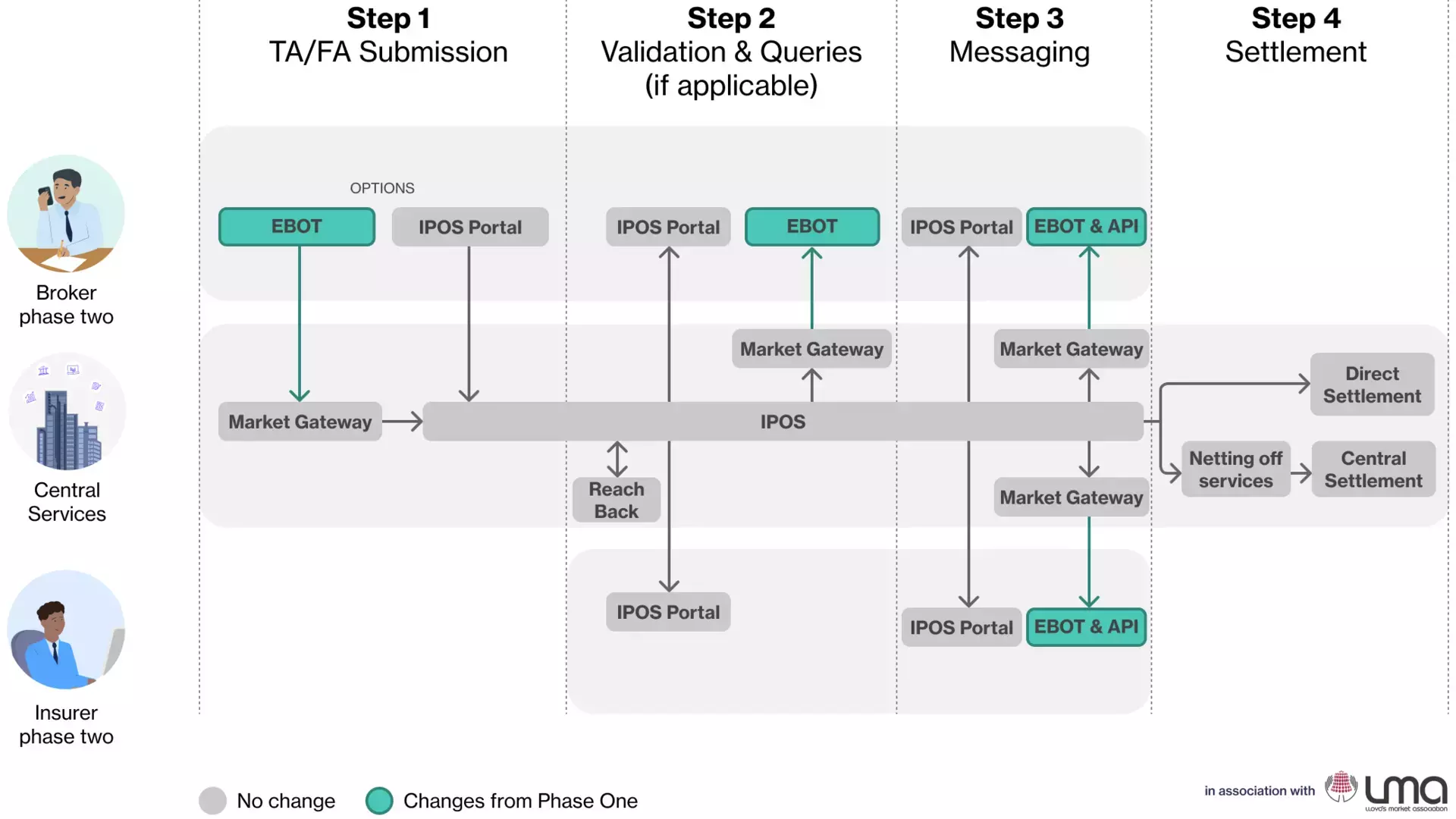

In this scenario, both the Broker and the Insurer have adopted phase two solutions

Step 1: TA/FA Submission

EBOT

ACORD-standardised messaging, EBOT, will be available from phase two. In this scenario, the broker who is in phase two, can trigger the premium accounting process via EBOT (both XML and API variants will be supported). This will trigger the separation of the technical account (TA) and financial account (FA). Insurers can opt to have a copy of the broker’s TA. EBOT specifications can be found here.

IPOS Portal

Portal access to IPOS will remain unchanged from phase one. In this scenario, the broker, who is in phase two, will be able to use the IPOS Market Portal for generating EBOT submissions to trigger the accounting process, as an alternative to generating messages via their own systems.

IPOS

IPOS, which has gone live in phase one, is the premium processing platform replacing LIDS. In this scenario, the broker is in phase two and uses the EBOT process, which will enable a higher level of automation of Velonetic’s (previously London Market Joint Ventures’) processes of accounting & settlement.

Step 2: Validation and Queries (if applicable)

Reach Back

In the case of a new transaction on an original premium which is held in legacy platforms (e.g., LIDS), such as in the case of endorsements, Reach Back will find the old premium data and bring it to IPOS, for a central view of the premium and premium history.

IPOS Portal

Both insurers and brokers (regardless of what phase they are in) will be able to manage queries via the IPOS portal, this will not change from phase one.

EBOT

In the Validation and Queries step, brokers who have adopted phase two can use EBOT to answer queries from Velonetic. Insurers are not going to be able to raise or answer queries using EBOT at this step.

Market Gateway

The Market Gateway (ASG Adept) will remain unchanged from phase one. All EBOT and API messaging will go through the Market Gateway (ASG Adept).

Step 3: Messaging

IPOS Portal

Both insurers and brokers will be able to view details of the signing on the IPOS portal, a functionality similar to Account Enquiry. Please note, this is not a reconciliation tool and will not contain the full data required to do reconciliation of transactions. This will not change from phase one.

EBOT & API

ACORD-standardised messaging, EBOT, is becoming available in phase two. In the scenario above, the broker in phase two sends an EBOT message, which means the insurer will get a copy of the broker's TA.. EBOT specifications can be found here.

Supplementary APIs will also provide information which is not available in the EBOT messages, such as non-fundamental splits, original signing number and date, actual payment date. API specs are expected to be published in end Q1 - end Q2 2024.

Some APIs have already been published and can be accessed on the ASG website. The API specification schedule, as well as instructions on how to access the API specifications currently available on the ASG website, can be found on the Blueprint Two website here.

Each organisation will have their own notification preferences, which will be unaffected by other organisations on the policy or claim. Therefore, an insurer who has selected EBOT and API as their notification preferences will only receive EBOT and API, even if other insurers on a policy use other formats.

Step 4: Settlement

Netting off services, Central Settlement

Net settlement will still occur through Central Settlement. Central Settlement is not changing and will still work via STFO for Lloyd’s and via RBS for the company market.

It is expected that there will be no changes to Central Settlement bank accounts. Central Settlement is expected to work as it does today but with feeds from the new digital services rather than the existing ones.

Direct Settlement

Direct Settlement will remain unchanged from phase one.

Managing Agent playbook links

Phase one

Phase two

Preparation

What is changing?

What is not changing?

What to do and when?

Known unknowns

Placement

Broker & Insurer phase one

Broker & Insurer phase two

Claims

Broker & Insurer phase one

Broker Phase two, Insurer Phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two

Premium Accounting & Settlement

Broker & Insurer phase one

Broker phase two, Insurer phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two

Claim Accounting & Settlement

Broker & Insurer phase one

Broker phase two, Insurer phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two