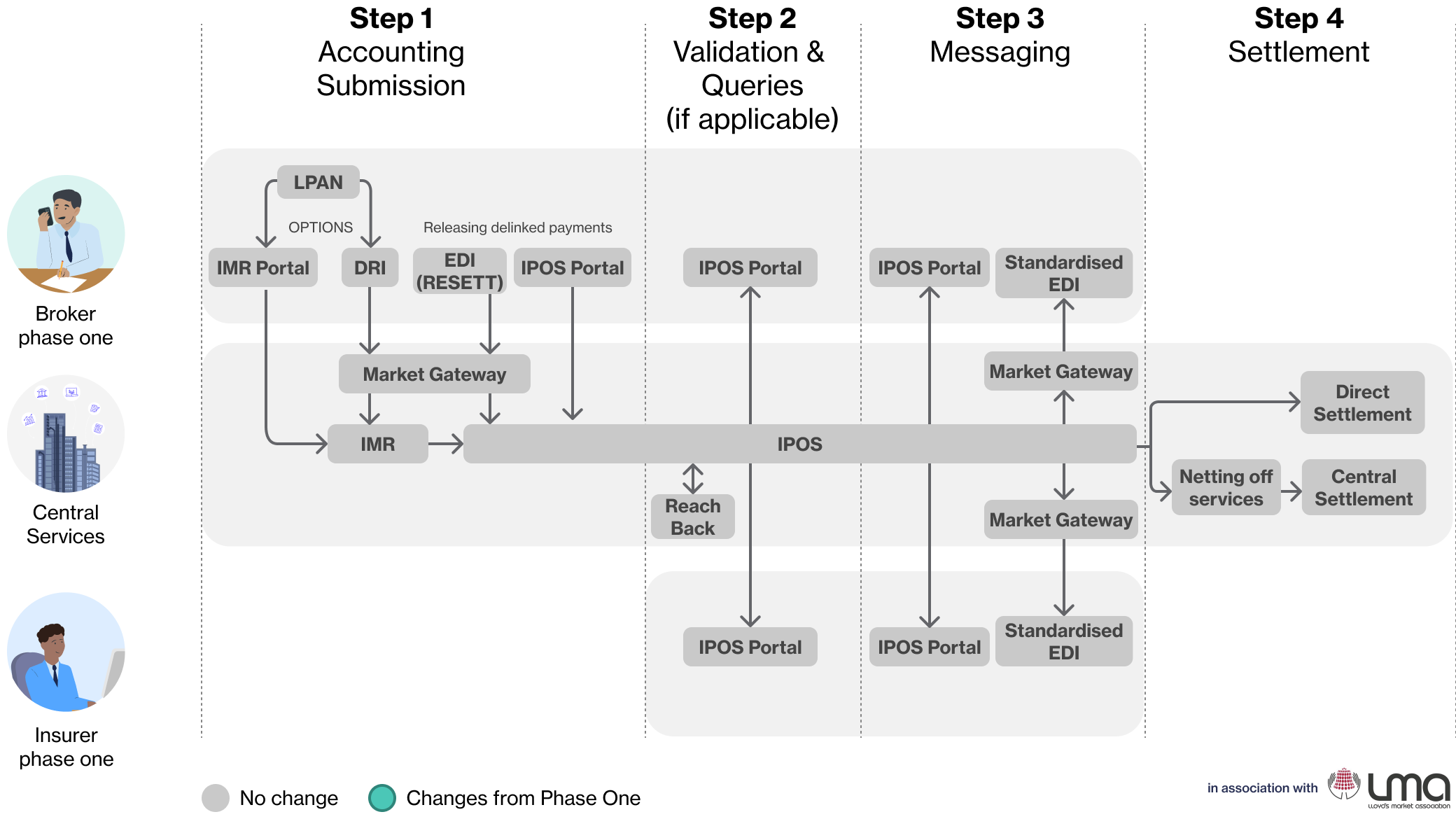

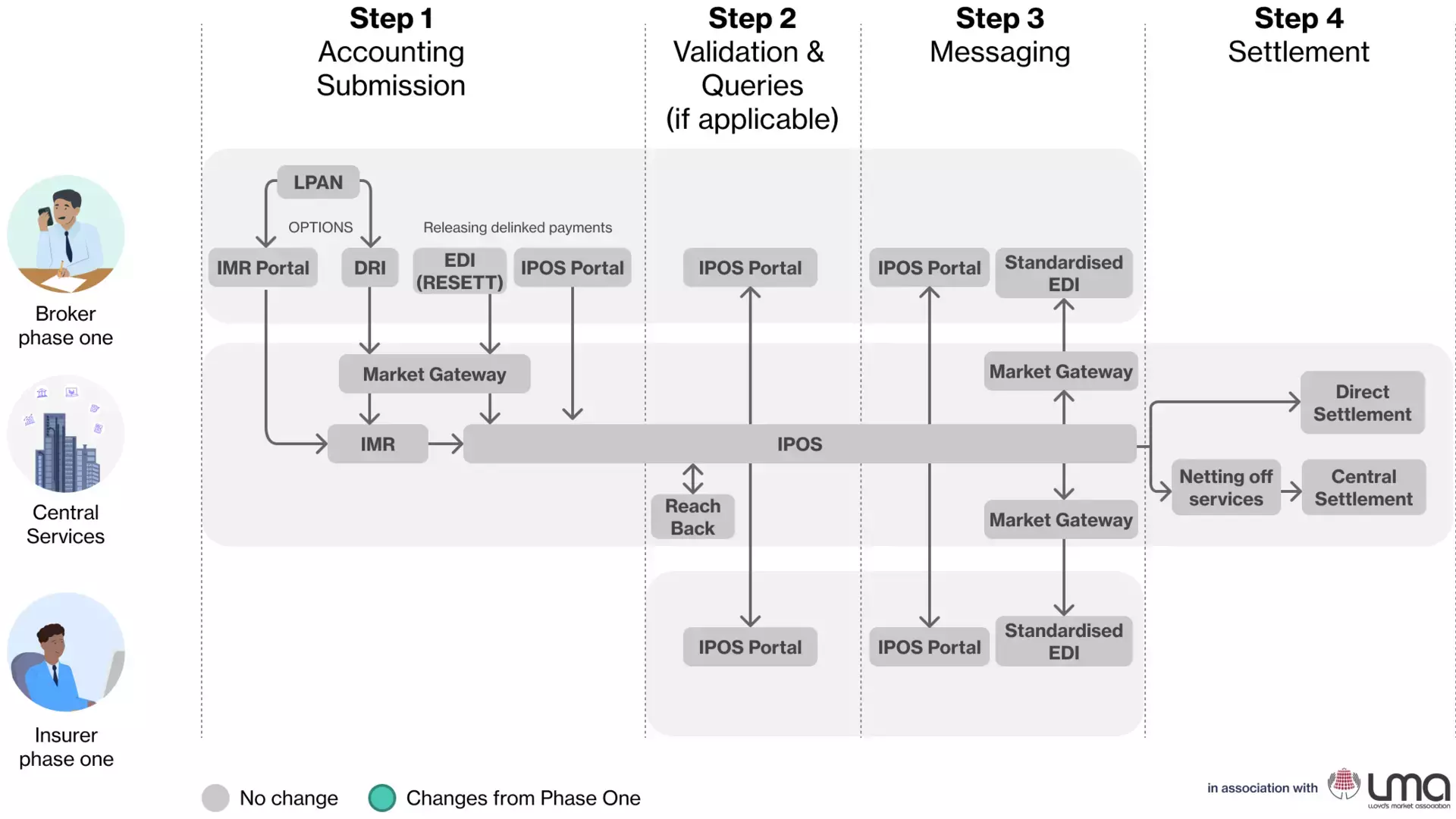

In this scenario, both the Broker and the Insurer have only adopted phase one solutions

Step 1: Accounting Submission

LPAN

LPANs can continue to be submitted to trigger the accounting and settlement process via two routes:

-

IMR

-

DRI

Market Gateway

The Market Gateway (ASG Adept) will remain unchanged from phase one. DRI messages to the IMR will be routed though the Market Gateway (ASG Adept), this will remain unchanged from phase one.

EDI (RESETT)

Brokers will be able to submit RESETT messages via the Market Gateway (ASG Adept) to IPOS to release delinked payments. This will remain unchanged from phase one.

IPOS Portal

Portal access to IPOS will remain unchanged from phase one. At accounting submission, the IPOS portal can be used by the broker to release delinked payments but not to submit an LPAN, which will continue to remain available via the IMR.

IPOS

IPOS, which has gone live in phase one, is the premium processing platform replacing LIDS. In the scenario above, where both broker and insurer continue operating in phase one, there will be no change to how it is used.

Step 2: Validation and Queries (if applicable)

Reach Back

In the case of a new transaction on an original premium which is held in legacy platforms (e.g., LIDS), such as in the case of endorsements, Reach Back will find the old premium data and bring it to IPOS, for a central view of the premium and premium history.

IPOS Portal

Both insurers and brokers (regardless of what phase they are in) will be able to manage queries via the IPOS portal, this will not change from phase one.

Step 3: Messaging

IPOS Portal

Both insurers and brokers will be able to view details of the signing on the IPOS portal, a functionality similar to Account Enquiry. Please note, this is not a reconciliation tool and will not contain the full data required to do reconciliation of transactions. This will not change from phase one.

Market Gateway

The Market Gateway (ASG Adept) will remain unchanged from phase one. All EDI messaging will go through the Market Gateway (ASG Adept).

Standardised EDI

Insurers and brokers who are still in phase one will receive Standardised EDI messages as they do in phase one.

Step 4: Settlement

Netting off services, Central Settlement

Net settlement will still occur through Central settlement. Central Settlement is not changing and will still work via STFO for Lloyd’s and via RBS for the company market.

It is expected that there will be no changes to Central Settlement bank accounts. Central Settlement is expected to work as it does today but with feeds from the new digital services rather than the existing ones.

Direct Settlement

Direct Settlement will remain unchanged from phase one.

Managing Agent playbook links

Phase one

Phase two

Preparation

What is changing?

What is not changing?

What to do and when?

Known unknowns

Placement

Broker & Insurer phase one

Broker & Insurer phase two

Claims

Broker & Insurer phase one

Broker Phase two, Insurer Phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two

Premium Accounting & Settlement

Broker & Insurer phase one

Broker phase two, Insurer phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two

Claim Accounting & Settlement

Broker & Insurer phase one

Broker phase two, Insurer phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two