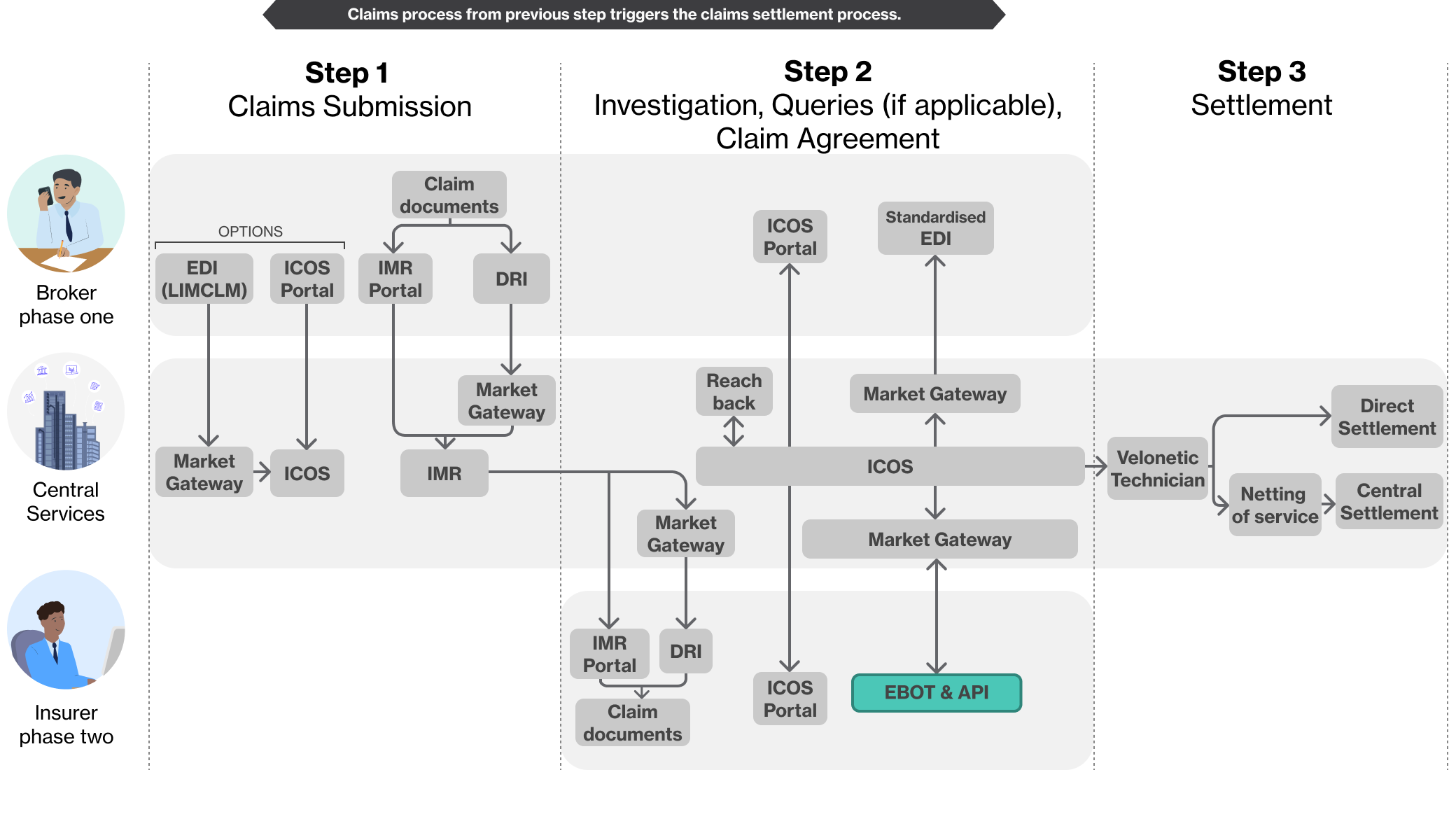

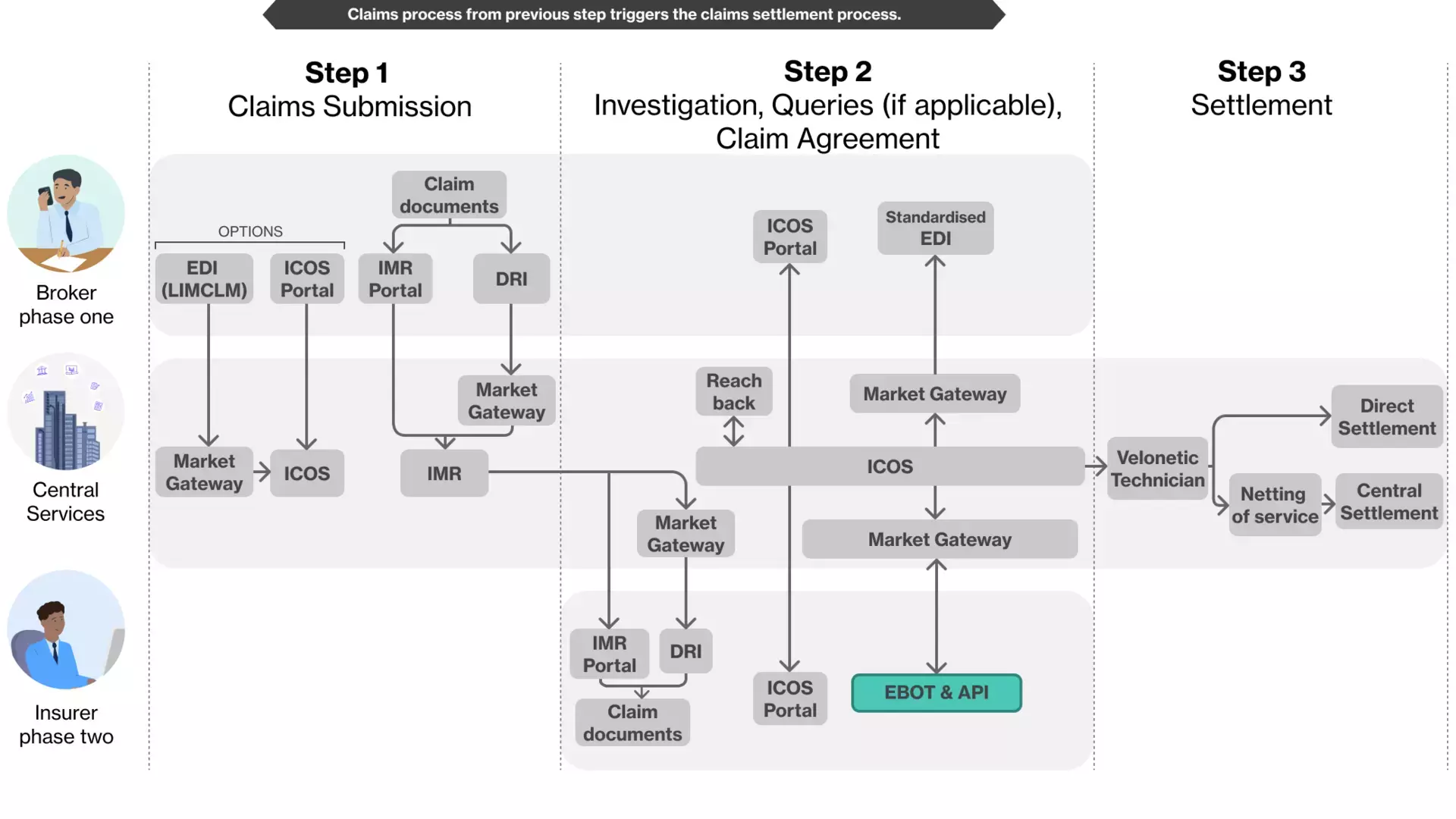

In this scenario, the Insurer has adopted phase two solutions while the Broker has only adopted phase one solutions

Step 1 & 2

Step 1 & 2 can be viewed here:

Step 3: Settlement

Velonetic Technician

A Velonetic (previously London Market Joint Ventures, or JV) technician will manually process the agreed Lloyd’s claim in order for it to go through to the settlement stage.

Netting off services, Central Settlement

Claims netted settlement will still occur through Central Settlement. Central Settlement is not changing and will still work via STFO for Lloyd’s and via RBS for the company market.

It is expected that there will be no changes to Central Settlement bank accounts. Central Settlement is expected to work as it does today but with feeds from the new digital services rather than the existing ones.

Direct Settlement

Direct Settlement will remain unchanged from phase one.

Managing Agent playbook links

Phase one

Phase two

Preparation

What is changing?

What is not changing?

What to do and when?

Known unknowns

Placement

Broker & Insurer phase one

Broker & Insurer phase two

Claims

Broker & Insurer phase one

Broker Phase two, Insurer Phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two

Premium Accounting & Settlement

Broker & Insurer phase one

Broker phase two, Insurer phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two

Claim Accounting & Settlement

Broker & Insurer phase one

Broker phase two, Insurer phase one

Broker phase one, Insurer phase two

Broker & Insurer phase two