Summary

Progress against our Blueprint Two goals

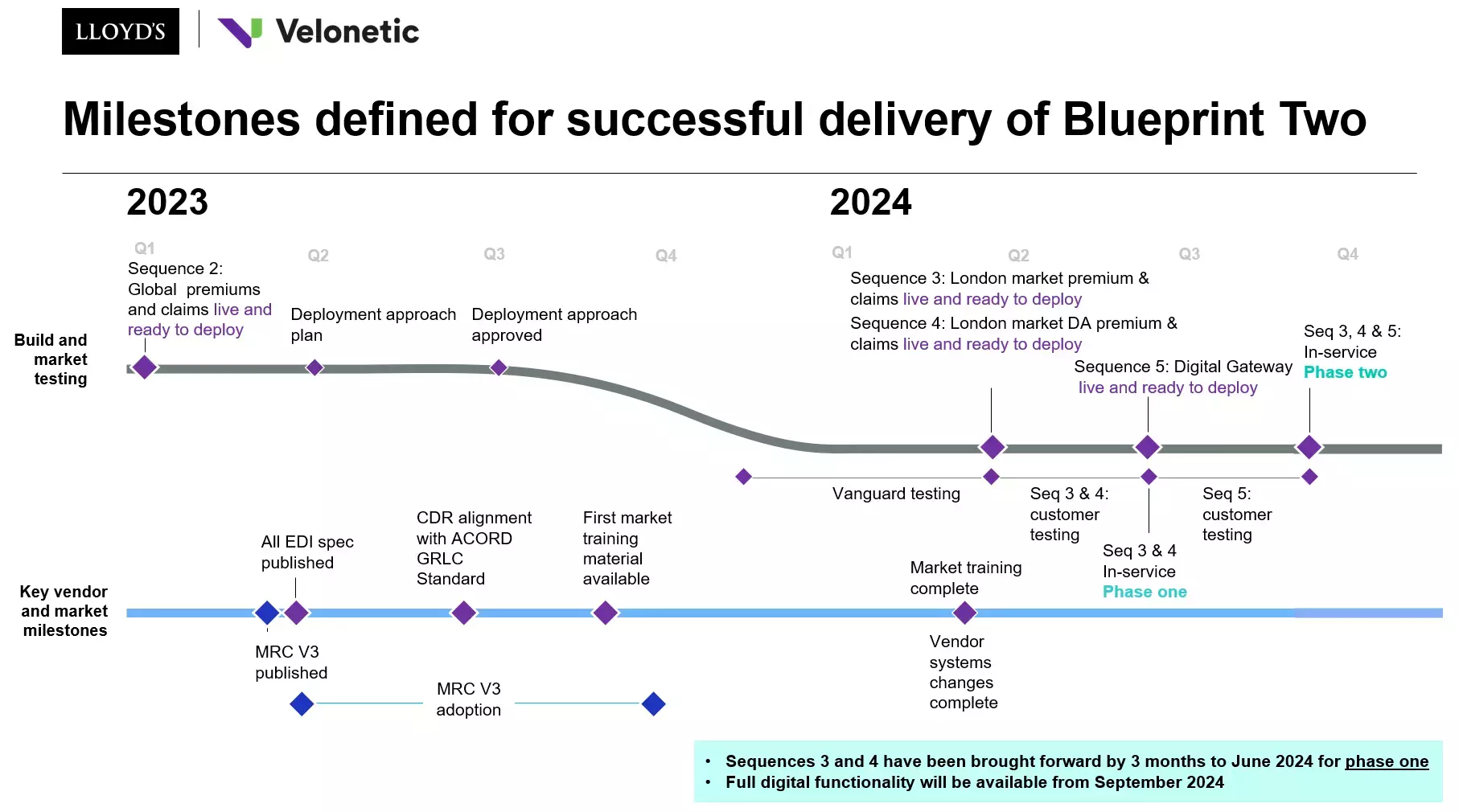

Through 2022 we published a quarterly update, tracking the progress made in delivering the digital solutions outlined in Blueprint Two. Those milestones were set out on a roadmap that was included in the second edition of the Interactive Guide.

We’ll continue to provide transparency around the key areas of programme delivery in 2023. To support our efforts, earlier this year we published an updated version of our Blueprint Two roadmap, with new targets covering ‘build and market testing’ and key vendor and market milestones’. The aim is to provide you with greater detail and insights on our plans of this year, including the key dates and actions market participants must take to effectively implement and benefit from the changes.

-

The largest part of programme execution in 2023 and 2024 is related to Velonetic, which will build the digital middle and back office to power the London market. The Global premium and claims service (Sequence Two) is live and ready to deploy and all EDI technical specifications were delivered.

-

Achievements in open market placement include the completion of the Process, Roles and Responsibilities (PRR) consultation, and the publication of the Market Reform Contract v3 (MRC v3) and the Core Data Record v 3.2 (CDR v.3.2).

-

Work has been completed to define the delegated authority data strategy for Lloyd’s and establish a set of guiding principles, before launching the strategy at the end of Q2 2023.

-

We are making improvements to the Lloyd’s Claims Scheme to streamline the claims agreement process for claims at Lloyd’s, to save time and effort by allowing more claims to be approved with a single agreement party.

-

For delegated authority claims, we have made significant progress in market adoption of the Faster Claims Payment solution; which now covers over 70% of delegated business at Lloyd’s.

-

Our market-wide Blueprint Two working session in February attracted 250 attendees and provided further detail on Velonetic's delivery plan, Digital Gateway, and the Global premium and claims service (Sequence Two).

-

Our Q1 market readiness survey also demonstrated continued progress in the market’s understanding of the solutions, benefits and changes they need to make.

Progress update

Below is a more detailed update on the major milestones to deliver upon the data first journey for open market placement, delegated authority placement, and claims.

Digital Processing

Sequence Two: Global premium and claims is live and ready to deploy

Velonetic's build will be completed in a series of five sequences. Sequence One, which laid the foundational components that will support the other sequences, was completed in Q4 2022 and Sequence Two, the Global premium and claims service, is live and ready to deploy. Velonetic's Business Development and Sales teams are in early conversations with market firms on their take up of this global specialty insurance service, which will support the management of premium movement and claims orchestration for singleton non-complex business. For more information on the global premium and claims service, please see the 9 February working session slides.

All EDI technical specifications published

Velonetic has delivered all EDI technical specifications as set out in its EDI technical specification release schedule. This allows vendors to make any amendments required to be able to produce or consume the new EDI messages. All materials are available on the Technical resources section of the Blueprint Two website.

Open market placement

Market Reform Contract v3 (MRC v3) published

The MRC v3 was published by the London Market Group Data Council (LMG) on 29 March. The MRC v3 provides the stepping stone to a data-first digital marketplace, playing a key role in embedding data standards and strengthening data quality for the London market. The updated MRC v3 will enable accurate, ACORD standardised data, including the Core Data Record (CDR), to flow through the entire insurance transaction lifecycle with minimal human intervention.

The MRC v3 reflects feedback gathered during the LMG Data Council's market consultation, supported by Lloyd's, which ran from June to September 2022. Thank you to everyone involved for their time, effort and expertise.

Core Data Record v3.2 (CDR v3.2) published

The CDR v3.2 sets out the data requirements for direct insurance and facultative reinsurance for all classes of business and territories within the company and Lloyd’s markets. This version has been updated to reflect the ongoing work with ACORD and the Market Reform Contract v3 (MRC v3).

The CDR will continue to evolve (for example, to accommodate changes in tax and regulatory requirements). Annual processes will be put in place to govern these changes which we will communicate in due course.

Next steps for market participants

-

Familiarise yourself with the MRC v3 and CDR v3.2, which have been published on the LMG and Blueprint Two websites.

-

Think about how your organisation requests and collects information, and compare the CDR to the information you typically collect and provide.

-

Direct any questions to your dedicated engagement partner.

Pre-register for the LIMOSS Market Business Glossary (LBG) from July 2023, where interactive versions of both the MRC v3 and CDR v3.2 will be published in due course. The LIMOSS MBG is a centralised source of business definitions, standards and reference data for use by the London market. To access the CDR via the LIMOSS MBG, you will need to have an ACORD license. You can find out more information on how to access the LIMOSS MBG here.

Process, Roles and Responsibilities (PRR) market consultation completed

The London Market Group (LMG) Data Council’s consultation looked to gather feedback on the recommended process of who creates and approves the CDR, and when this will be submitted to the Digital Gateway.

There was an overwhelming response to the consultation, with over 3000 comments received from 90 organisations. Thank you to everyone involved for sharing their feedback and expertise. Once the feedback has been analysed, we’ll publish our proposed recommendations in Q2 2023.

Delegated authority placement

Delegated authority (DA) data strategy guiding principles set

Following engagement with the LMA, the IUA and market participants, we have determined an understanding of the challenges faced by the DA community, and established a set of guiding principles which will serve as the foundation to build out the DA data strategy in 2023. These principles include using one standard where possible for both DA and open market business, creating a data first route powered by APIs, and enabling optionality for participants on technology choices.

In Q2 2023, we’ll continue to work closely with the Data Council and Velonetic to explore how these principles can be leveraged, in line with the Data Council standards, and how the Blueprint open market API solutions can be broadened for delegated authorities. We aim to publish the detail of the DA data strategy at the end of June.

Claims

Faster Claims Payment roll-out continues

Since the launch of the Faster Claims Payment (FCP) solution in September 2022, almost half of all managing agents have signed up to the service, representing more than 70% of delegated authority gross written premiums at Lloyd’s (GWP). Lead and follow underwriters, brokers and delegated claims administrators (DCAs) are all vital to our continued expansion. FCP is our transformative new funding and payment solution, providing fast and direct payment of customers’ claims through the Vitesse payment platform.

Vitesse are offering an 'FCP accelerator' programme at no extra cost and tailored to each managing agent, with monthly reconciliation support; third-party software integration support; a dedicated success manager; and other account, product and technical support and forums.

Next steps for market participants

-

Understand which lead and follow syndicates, brokers and DCAs are ‘FCP ready’ and which are ‘FCP live’ on the LIMOSS FCP website.

-

The LIMOSS website also has self-service training material available to assist you.

-

Please email [email protected] for more information or to receive a copy of the end-to-end process guide.

Lloyd’s Claims Lead Arrangements

During Q1 2023, following extensive engagement with relevant market groups, we conducted a consultation on improvements to the Lloyd’s Claims Scheme, which will be renamed the Lloyd’s Claims Lead Arrangements to better describe the aims. More claims will now require only one agreement party, so brokers will only need to deal with one managing agent, saving time and effort and ensuring that the right level of expertise is allocated to the claim at each stage.

We are currently reviewing the responses received and will publish our final proposals in Q2.

Next steps for market participants

-

Learn more about the consultation here.

Any questions regarding the proposed changes can still be sent to [email protected].

Market engagement

Ongoing engagement is critical to build and deliver appropriate, relevant and adoptable solutions that provide value and benefit to your organisation, our market and ultimately our customers.

Along with regular one-to-one engagement with market firms, we held 13 market events in Q1, including a market-wide Blueprint Two working session on 9 February with over 250 attendees. The event covered our plans to deliver Blueprint Two, the Digital Gateway, the International Premiums Orchestration Service (IPOS) and the International Claims Orchestration Service (ICOS) – the core digital solutions for premium processing and open market claims processing respectively – and provided market participants with the opportunity to ask questions within dedicated breakout sessions. The slides and recordings from the session are available here.

Blueprint Two carrier sessions were held on 11 and 12 January focusing on planning for 2023 with input from ACORD, key service providers and market associations.

The Q1 2023 market readiness survey was published on 28 February, demonstrating continued progress in the market’s understanding of Blueprint Two solutions, the benefits and the changes that need to be made. There was also a notable step forward in market firms working with their service providers demonstrating a focus on readiness planning.

13 market firms have also been identified to potentially participate in the Vanguard programme, which aims to build out plans for early testing of Velonetic's solutions. Conversations continue to finalise participation.

Updated customer journeys were published in January covering more detailed messaging flows for the Digital Gateway, IPOS and ICOS, to help build knowledge on how the new messaging flows will work. A company market Foundational Playbook was also launched on 18 January.