Summary

Progress against our Blueprint Two goals

We’re committed to providing regular updates on our progress in delivering the digital solutions outlined in Blueprint Two – both in person at our quarterly events and through other additional communications channels.

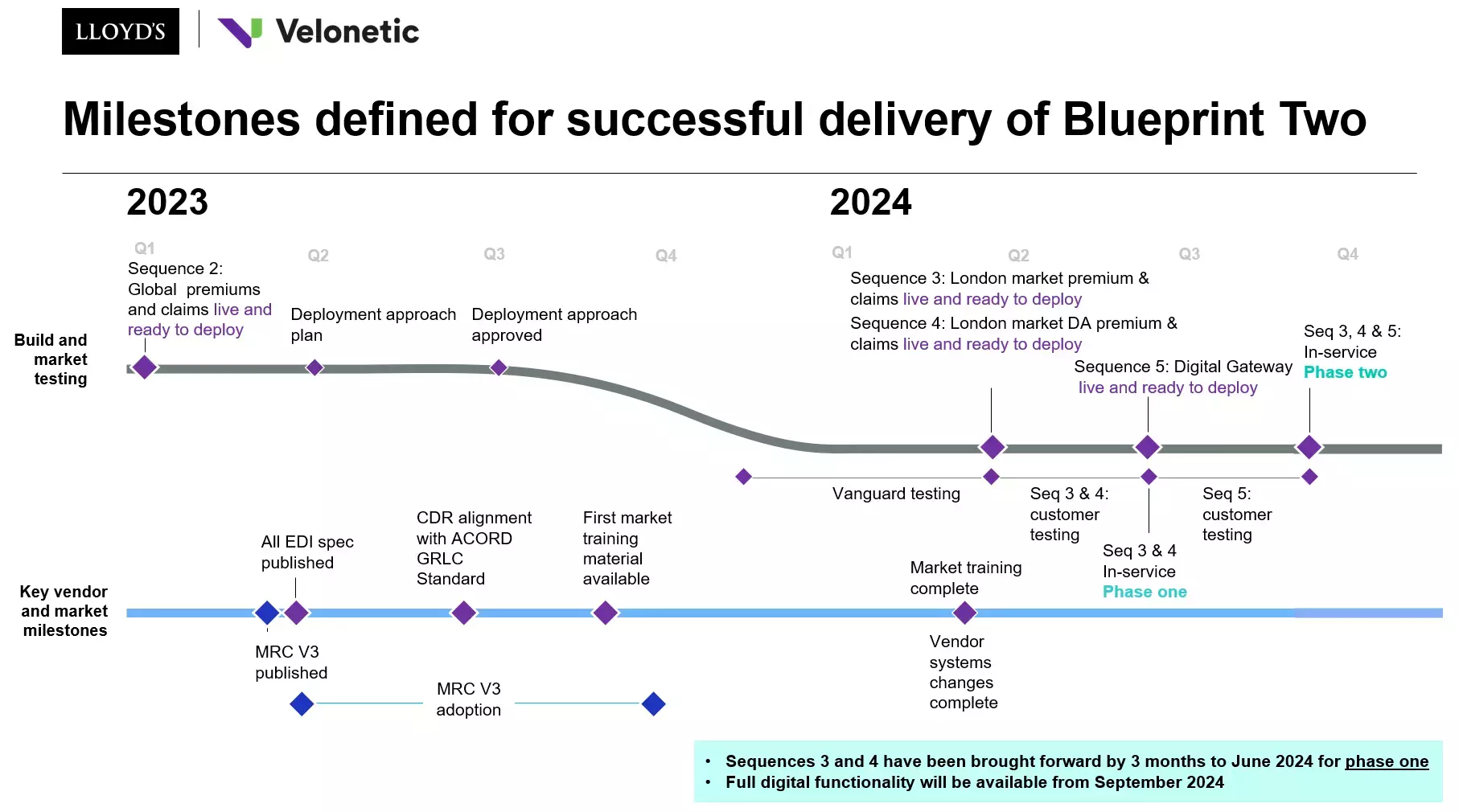

Our Q2 2023 update covers the formal milestones set out in the Blueprint Two roadmap as well other developments including key dates and actions market participants must take to effectively implement and benefit from the changes.

-

We’re at an exciting stage of delivery, and our Blueprint Two working session hosted on Monday 19 June saw over 450 market participants come together to hear about the progress made and the details organisations need to prepare for the new digital solutions. If you didn’t attend the session, we strongly encourage you to view the recording here and share the update with your colleagues.

-

Key takeaways from the working session include:

-

Strong progress made in the first half of 2023, and we’re on track to complete the remaining digital processing sequences following the delivery of Sequence 1 (foundational digital capability) and Sequence 2 (global premium and claims capability)

-

There are actions you can take now in order to adopt the new Market Reform Contract (MRC v3) and the Core Data Record (CDR), EBOT and ECOT messages, as well as defining your API strategy

-

Our cohort of early adopters, known as the Vanguard programme, will begin testing from January 2024

-

Phase 1 delivery of the digital solutions (previously called ‘transitional services’) will be brought forward by three months to June 2024, outlined in the roadmap. Phase 2 (previously known as ‘full digital’) will be available to adopt from September 2024

-

-

In open market placement, achievements include the publication of the outcomes from the Process, Roles and Responsibilities (PRR) consultation and aligning the CDR with the globally-recognised ACORD GRLC standard.

-

The new Claims Lead Arrangements went live on 1 June, and our Faster Claims Payment team has been busy supporting managing agents to aid usage and adoption of the solution.

-

As our focus now moves to adoption, the Lloyd's and Velonetic team continues to support market participants in defining their adoption strategies. You can read about the various forums, the model office space and Vanguard programme in more detail below.

You will note references to Velonetic in our update. On 18 September, Velonetic was announced as the new brand identity for the London Market Joint Ventures (a shareholding between DXC Technology, the International Underwriting Association (IUA), and Lloyd’s). You can find out more about the work Velonetic is doing to support insurance business processing today, and their build of new digital services for 2024 on their new website.

Progress update

Here you’ll find more detail on the major milestones to deliver solutions across open market placement, delegated authority placement, and claims.

Digital processing

Deployment approach

At the Blueprint Two working session on 19 June 2023, we shared the testing approach and deployment plan for market participants.

As a reminder, the digital processing platform build is being delivered in five sequences:

-

Sequence 1 – the foundational capability of the platform for all new services, completed at the end of 2022.

-

Sequence 2 – global premium and claims processing service went live in March 2023 and is in-service for singleton, peer-to-peer, non-complex business. Please contact the JV’s Customer Relationship Management Team to find out more.

-

Sequence 3 – the London market premium and claims processing services are on track to be live and in-service for market firms at the end of June 2024 (in parallel with Sequence 4).

-

Sequence 4 – the delegated authority premium and claims processing services are on track to be live and in-service for market firms at the end of June 2024 (in parallel with Sequence 3).

-

Sequence 5 – the Digital Gateway risk service will be live and in-service at the end of August 2024.

As we prepare for the deployment of the new digital processing services, we’ve created a testing and adoption plan that has market participants front and centre, avoiding the peak times and seasonality of the marketplace (such as 1/1 renewals).

Testing

The Vanguard early adopters will begin testing phase 1 of the digital services in January 2024, before phase 1 testing is rolled out to all market participants from March 2024. We anticipate the Vanguard testing approach will reduce the amount of testing required for other market participants.

Adoption

All market participants can adopt phase 1 of the digital services when they go live in June 2024. The option to move to phase 2 of digital services (a ‘full digital’ approach) will be available from September 2024, provided phase 1 has been adopted.

More information will be provided at the next Blueprint Two working session on Monday 25 September 2023.

Find out more about the Blueprint Two working session

Please contact the JV’s Customer Relationship Management Team to find out more

Open market placement

Work to align the Core Data Record (CDR) with the globally-recognised ACORD GRLC standard has been completed

The CDR v3.2 was updated to reflect the ongoing work with ACORD in March 2023. ACORD are now socialising the proposed changes with their governance committees, which will result in the publication of a revised and aligned GRLC standard in Q3 2023.

The CDR v3.2 sets out the data requirements for direct insurance and facultative reinsurance for all classes of business and territories within the company and Lloyd’s markets.

The CDR will continue to evolve (for example, to accommodate changes in tax and regulatory requirements). Annual processes will be put in place to govern these changes which are currently being discussed with the Data Council.

Next steps for market participants

-

Familiarise yourself with the CDR v3.2, which has been published on the LIMOSS Market Business Glossary (MBG), LMG and Blueprint Two websites. o Interactive versions of both the CDR v3.2 and MRC v3 are available through the LIMOSS MBG, which is a centralised source of business definitions, standards and reference data for use by the London market. To access the CDR via the LIMOSS MBG, you will need to have an ACORD license. You can find out more information on how to access the LIMOSS MBG below.

-

Think about how your organisation requests and collects information, and compare the CDR to the information you typically collect and provide.

-

Direct any questions to your dedicated engagement partner.

London Market Group Data Council (LMG)

Process, Roles and Responsibilities (PRR) market consultation outcomes published

-

On average, 90% of carriers and 80% of brokers who responded to the consultation had a favourable or neutral view on the proposed plans put forward in the LMG Data Council’s PRR consultation. Thank you to everyone who shared their input.

-

The consultation looked to gather feedback on the recommended processes of who creates and approves the CDR, and when this will be submitted to the Digital Gateway.

-

You can now view more detailed outcomes of the consultation, including the infographic and full report, on the dedicated consultation site.

-

Following agreement with the LMG Data Council, a trilogy of the final PRR recommendations, ACORD implementation guide and good practice guide will be issued between July and October 2023.

Claims

Faster Claims Payment: loss fund data analysed to enable greater usage

With more than half of all managing agents signing their Market User Agreement (MUA) for the Faster Claims Payment (FCP) solution, the goal for Q2 was to encourage greater usage of the system and help in the transfer of in-scope binder contracts to the platform.

The FCP team has analysed loss fund and binder contract data for each managing agent, to understand the number and value of their loss funds, both as a leader and a follower, and which eligible binders can be used with FCP now to begin to realise the full value for the market.

FCP is our transformative new funding and payment solution, providing fast and direct payment of customers’ claims through the Vitesse payment platform. The 30 managing agents signed up to use the solution represent more than 80% of delegated authority GWP.

Vitesse are also offering an FCP accelerator programme at no extra cost and tailored to each managing agent, with monthly reconciliation support; third-party software integration support; a dedicated success manager; and other account, product and technical support and forums.

Next steps for market participants

-

Please email [email protected] for more information or to arrange a meeting if you have not yet met with the team to receive your data analysis.

-

Understand which lead and follow syndicates, brokers and DCAs are ‘FCP ready’ and which are ‘FCP live’ on the LIMOSS FCP website to assist with binder selection.

-

The LIMOSS website also has self-service training material available to assist you.

Lloyd’s Claims Lead Arrangements live on 1 June 2023

The new Lloyd’s Claims Lead Arrangements (formerly the Lloyd’s Claims Scheme) were approved by the Lloyd’s Council on 10 May 2023, following a consultation on the finalised set of changes in January and February, endorsement by the LMA CC and the LMA Board in March and the publication of the proposed changes in April. There are extensive benefits for market participants and policyholders, freeing up expert resources to focus on the most complex claims situations, with the aim of ensuring a single Lloyd’s claims agreement party across the majority of open market and delegated authority business.

Prior to go-live on 1 June 2023, all claims handers were required to undertake new training modules, and claims leaders to review the other supporting resources.

More information, including a link to the training and resource materials on the LMA website, is available here.

Market engagement

Ongoing engagement is critical to build and deliver appropriate, relevant and adoptable solutions that provide value and benefit to your organisation, our market and ultimately our customers.

Model office

To aid your understanding and adoption of the solutions, we’ve created a new model office space on Gallery 3 of the Lloyd’s building, designed to illustrate the future processes that Blueprint Two will enable. Interactive storyboards explain the current process of placing risk and making a claim in the Lloyd’s and London market, highlighting challenges in the current journey, the technology solutions being built through Blueprint Two, and the benefits the new technology will bring for brokers and underwriters.

We’ll be creating more content over the coming weeks and months, taking the model office experience online by the end of September and expanding our model office presence to the Joint Ventures’ new purpose-built space on Gallery 4 later in Q4. You’ll also start to see various events and briefings hosted in the space; for more information, contact your engagement partner. You’re also welcome to visit the model office at your own leisure.

Market interoperability

In May, we shared a number of scenarios with the market to demonstrate how firms can work together regardless as to whether they have adopted phase 1 or 2 of the digital services. The scenarios covered how brokers and carriers can work together effectively, and how messages would flow from non-digital to digital and back for premium accounting and settlement, and claims. A recording of the event and slides can be found here.

Vanguard early adoption programme

We’ve been working with a number of brokers and carriers to identify those that would be keen to engage in the early testing of phase 1 and 2 digital services. We currently have 15 firms signed up to support our testing of the new solutions. This approach will help highlight early successes and potential challenges that market firms may experience and will be a valuable contribution to the success of Blueprint Two. For more information, or if you’d like to sign up to be an early adopter as part of our Vanguard programme, contact Bob Verber, Commercial Director at Velonetic.